Home » Crime and Fraud • US business news » Historic Fraud Cases That Transformed The World

Historic Fraud Cases That Transformed The World

https://www.whatjobs.com/news/business-crime-and-fraud/three-historical-fraud-cases-that-transformed-the-world

By Hugh Fort in Crime and Fraud, posted March 27, 2024

Fraud is an enormous cost to the US economy each and every year.

The cost is around $5 trillion - yes, you read that right.

That's the same as the annual gross domestic product of Japan lost to criminals.

This threat portrays a considerable challenge for businesses.

Fraudsters are getting smarter, and their efforts are becoming more sophisticated, from elaborate identity frauds to Wangari scams.

But the authorities do learn from such crimes, and have made changes to try to reduce the chances of them happening again.

Here are three cases of historical fraud with lasting consequences that changed the world.

François and Joseph Blanc: 1830s

Strangely, the first telecommunications scam came in 1837 - which was 50 years before the telephone was invented.

Alexander Graham Bell wasn't even born when this scam came around.

Francois and Joseph Blanc were traders in the Bordeaux stock exchange in the 1830s.

They traded government bonds, and the valuations were massively impacted by the goings-on in Paris, 600 kilometers to the north in France.

Travel between the two cities took around a week in those times, which gave the brothers ample time to trick their fellow traders.

The main communication technology was called the optical telegraph - which was made up of giant towers with signaling arms made of wood that could send messages across the country.

Messages were delivered through a relay, and each tower would pass on the message to the next.

The brothers found a way to hack this network.

The did this by bribing a signaller to send secret messages about changes in the stock market changes in Paris.

Although this was very obviously a fraud, the brothers avoided prison because there was no law in France that actually made this illegal.

Even nearly 200 years ago, fraudsters were always looking for new ways to get cash through nefarious means.

Laws were soon introduced to combat such practices.

Barings Bank- 1995

Nick Leeson is famous as the man who brought down Barings Bank - and now works to expose financial fraudsters.

This case 27 years ago exposed a chronic lack of supervision in financial reporting.

As head of the bank in Singapore, Leeson initiated a financial crisis that led to the bank collapsing.

Leeson gambled more than $1 billion in unhedged positions on markets and then forged his accounting records to try to hide what he had done.

The markets didn't turn in his favor, which made what he'd done even worse.

His actions were so bad they led to the entire bank collapsing.

He then admitted what he'd done to the bank.

The case led to a massive change as it revealed a huge failure by the bank for allowing him to manage positions and oversee accounting operations.

What this meant was that having access to both allowed Leeson to hide his trail too well.

The bank's collapse meant stricter measures were put in place at banks to stop similar crimes happening again.

Leeson’s losses totaled $1.4 billion, which was twice the available trading capital of the company, which sent it under.

He was sentenced to six and a half years for his crimes and sent to prison in Singapore.

He survived colon cancer and now makes a living as an after-dinner speaker.

Need Career Advice? Get employment skills advice at all levels of your careerv

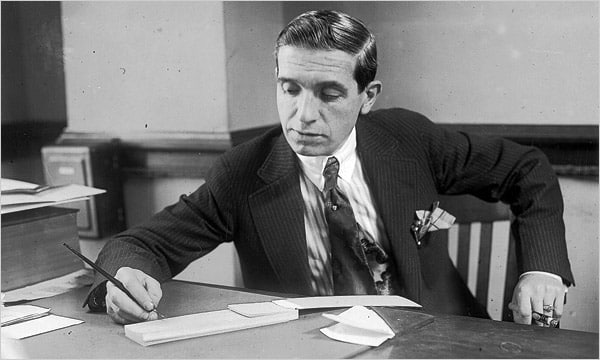

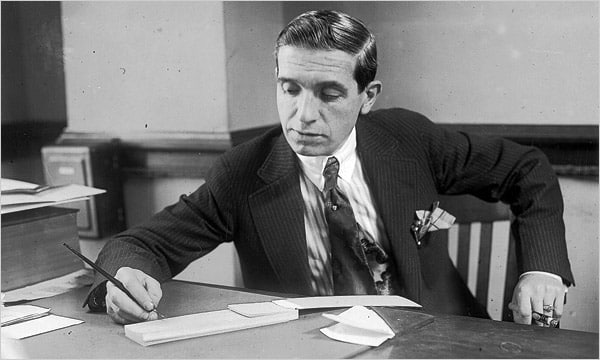

Charles Ponzi fraud – 1920s

You know a fraud is a big one when future massive crimes are named after its perpetrator.

Charles Ponzi's crimes took place more than a century ago and the term "Ponzi scheme" is now used for similar enormous financial scams.

The actual fraud involved the infamous Charles Ponzi convincing investors he could provide returns based on currency valuations through buying international postal coupons.

The investors were promised returns early in the scheme.

This was 50 percent profit within 45 days and 100 percent within 90 days.

Ponzi used later investments to pay those promises to earlier funders, urging others through his miraculous returns.

READ MORE ABOUT THE PONZI SCHEME HERE

He was eventually brought down by the Boston Globe.

Ponzi was charged with 86 counts of mail fraud.

Despite the magnitude of his crimes, he was jailed for just five years.

He served three-and-a-half years, and upon his release was charged with 22 counts of larceny (theft of personal property).

After three trials, he was finally found guilty and sentenced to an additional seven to nine years as a "common and notorious thief."

He died in 1948 at the age of 62.

Follow us on YouTube, X, LinkedIn, and Facebook